Interpreting Credit Reports: A Guide for Real Estate Investors and Landlords

Savvy landlords and real estate investors need to unlock the secrets on how to use tenant credit reports for effective screening, optimizing rental income through thorough background checks and credit score interpretation, while employing best practices in property management to assess tenant reliability, mitigate risks, and boost profitability in the competitive rental market.

As a real estate investor or landlord, one of your most crucial tasks is evaluating potential tenants. A key tool in this process is the credit report. Understanding how to interpret these reports effectively can significantly impact your property management success and minimize financial risks.

Why Credit Reports Matter

Credit reports provide valuable insights into a potential tenant’s financial history and reliability. They offer a comprehensive view of an individual’s credit behavior, payment history, and overall financial stability. For landlords, this information is vital in assessing whether a tenant is likely to pay rent consistently and on time.

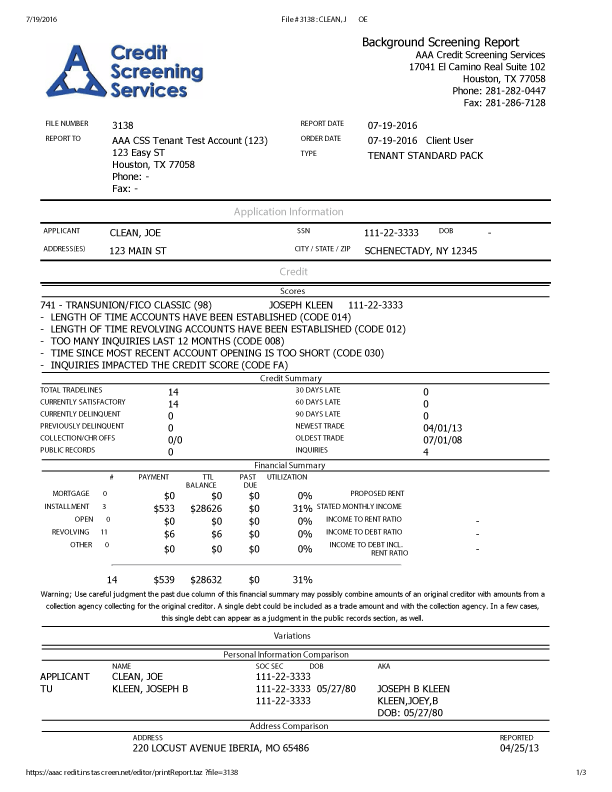

Key Components of a Credit Report

Personal Information

Verify that the name, address, and other personal details match the information provided by the applicant. Discrepancies could indicate potential identity issues or errors in the report.

Credit Score

The credit score is a quick snapshot of the applicant’s creditworthiness. While it shouldn’t be the sole deciding factor, it provides a useful starting point:

- 750+: Excellent credit

- 700-749: Good credit

- 650-699: Fair credit

- 600-649: Poor credit

- Below 600: Very poor credit

Payment History

This section is crucial as it shows how consistently the applicant pays their bills. Look for:

- Late payments

- Missed payments

- Collections

- Bankruptcies

A pattern of late or missed payments could be a red flag, indicating potential issues with future rent payments.

Credit Utilization

This refers to how much of their available credit the applicant is using. High utilization (over 30%) might suggest financial stress, even if payments are current.

Length of Credit History

Longer credit histories generally provide more reliable information about an applicant’s financial behavior.

Types of Credit

A mix of credit types (credit cards, loans, etc.) can indicate responsible credit management.

Recent Credit Inquiries

Multiple recent inquiries might suggest the applicant is seeking numerous new credit lines, which could be a sign of financial distress.

Interpreting the Report

When reviewing a credit report, consider these factors:

- Overall Pattern: Look for consistent, responsible credit behavior over time.

- Recent Improvements: If there are past issues, have they been resolved? Is there a clear trend of improvement?

- Extenuating Circumstances: Major life events (job loss, medical issues) might explain past credit problems. Consider these in context.

- Debt-to-Income Ratio: Ensure the applicant’s income is sufficient to cover rent along with existing debts.

Red Flags to Watch For

- Multiple collections or charge-offs

- Recent bankruptcies or foreclosures

- High credit utilization across multiple accounts

- Pattern of late payments, especially on rent or utilities

- Numerous recent credit inquiries

Beyond the Credit Report

While credit reports are valuable, they shouldn’t be your only screening tool.

Consider:

- Employment Verification: Stable employment history is crucial.

- Income Verification: Ensure the applicant’s income meets your requirements (typically 3x the monthly rent).

- Rental History: Contact previous landlords for references.

- Criminal Background Check: This can reveal potential safety concerns.

Legal Considerations

Be aware of fair housing laws and regulations regarding tenant screening. Ensure your screening process is consistent and non-discriminatory. Always obtain written consent before pulling a credit report.

Making the Decision

When interpreting a credit report, balance the information against your specific criteria and risk tolerance. Some landlords might be willing to accept a tenant with a lower credit score if they can provide a larger security deposit or a co-signer.

Communicating with Applicants

If you decide to reject an applicant based on their credit report, you’re required by law to provide an adverse action notice. This should include:

- The reason for rejection

- The name and contact information of the credit reporting agency used

- Information on the applicant’s right to obtain a free copy of their credit report

Conclusion

Interpreting credit reports is a crucial skill for real estate investors and landlords. It helps mitigate risks and find reliable tenants who are more likely to pay rent on time and take care of your property. By understanding the key components of a credit report and what they signify, you can make more informed decisions and potentially avoid costly evictions or property damage down the line.

Remember, while credit reports are a powerful tool, they should be part of a comprehensive screening process that includes employment verification, rental history, and personal references. This holistic approach will give you the best chance of finding quality tenants for your properties.

Need coaching? Get in touch with Maria Rekrut on all the social media platforms!

SET UP A FREE APPOINTMENT HERE: https://calendly.com/realwealthradio

http://realwealthrealestate.com/

https://www.facebook.com/maria.rekrut

https://www.linkedin.com/in/mariarekrut

https://www.pinterest.ca/rekrutmaria

Real Estate Investor, Land Developer, Owner of Short- and Long Term Rentals, Educator, Blogger, Writer, Author of Double Your Income Using Social Media, Radio and TV Show Host and Producer of the All Things Real Estate Show on: https://4680q.com/ Radio Station Owner of: https://realwealthradio.ca/

LandlordLife, #RealEstateInvesting, #TenantScreening, #CreditReportAnalysis, #RentalProperty, #PropertyManagement, #RentalIncome, #RealEstateSuccess, #TenantSelection, #CreditScoreMatters, #RentalMarket, #LandlordBestPractices, #TenantApproval, #CreditReportGuide, #RentalPropertyTips, #LandlordStrategies, #TenantVetting, #CreditHistoryAnalysis, #RealEstateWealth, #LandlordResources, #TenantCreditCheck, #RentalSuccessStories, PropertyInvestmentTips, #TenantScreeningProcess, #RentalIncomeOptimization, #CreditScoreInterpretation, #LandlordEducation, #RealEstateRiskManagement, #TenantFinancialHistory, #RentalPropertyROI, #CreditReportRedFlags, #LandlordDecisionMaking, #TenantQualityAssessment, #RealEstatePortfolioGrowth, #CreditUtilizationAnalysis, #LandlordLegalCompliance, #TenantRelationshipManagement, #RentalMarketInsights, #CreditHistoryEvaluation, #LandlordProductivity, #TenantRetentionStrategies, #RealEstateInvestmentSuccess

Citations:

[1] https://www.biggerpockets.com/blog/evaluating-credit-reports

[2] https://www.debtcare.ca/the-complete-guide-to-credit-repair-for-real-estate-investors/

[3] https://www.boiseturnkey.com/five-things-you-have-to-know-about-credit-scores-and-real-estate-investing

[4] https://www.youtube.com/watch?v=QfS6G0ex-vU

[5] https://mathesonattys.com/blog/real-estate-and-your-credit/

Follow

Follow